CloseTrade Stock Like Fantasy Sports

Jumping into the world of trading is exciting – the idea of buying your first stock or catching the next big market move can feel empowering. But for most beginners, that excitement quickly turns into fear.

The numbers don’t lie: studies show that more than 70% of DIY (retail) investors lose money, and nearly 97% of day traders lose money within their first 300 days. No wonder so many people hesitate before making their first real trade.

Trading isn’t just about spotting opportunities – it’s about handling risk, managing emotions, and building discipline. In fact, as trading author Jack Schwager once said, “Amateurs think about how much money they can make. Professionals think about how much money they could lose.” This mindset shift is often what separates successful traders from those who quit early.

The good news?

There’s a way to build skills, test strategies, and gain confidence without putting a single dollar at risk: paper trading. And with the growth of modern platforms, paper trading has evolved from old-fashioned notepads into realistic stock market simulation tools designed to help anyone – from students to aspiring investors – safely learn stock market and master the basics of investing.

In this article, we’ll explore what paper trading is, how it works, why it’s different from real trading, and how platforms like Rally Bulls are making it smarter, more engaging, and more effective than ever before.

Paper trading is a way to practice stock trading without using real money. Instead of risking your savings, you trade with virtual funds in a simulated environment that mirrors real market conditions. The term comes from a time when aspiring traders would literally “trade on paper” – writing down hypothetical buys and sells to see how their strategies would have worked.

Today, paper trading has gone digital. Platforms now offer realistic stock market simulation environments powered by live market data. That means when a company like Apple releases earnings or the stock market reacts to global news, your practice trades respond just as they would in the real world – but without financial consequences.

Paper trading transforms theory into experience, making complex concepts tangible. For anyone eager to build financial literacy, it’s one of the most effective starting points. While these benefits make paper trading incredibly valuable, it’s important to see how it compares to real trading in terms of risk, emotions, and learning outcomes.

While paper trading is one of the best ways to start, it’s important to understand how it differs from live stock trading. Both experiences share similarities – real-time price data, portfolio management, and decision-making – but there are key differences that impact how you learn.Financial literacy is not a one-time lesson – it’s a lifelong skill that impacts your financial confidence, security, and success at every stage of life. From your first paycheck to retirement, understanding how to manage money and invest can make all the difference.

Here’s a side-by-side breakdown:

| Aspect | Paper Trading (Simulation) | Real Trading (Live Market) |

| Money at Risk | Uses virtual funds, no financial risk. | Uses real money, potential for gains and losses. |

| Market Data | Often powered by stock market simulation with live or delayed feeds. | Real-time market conditions with direct financial consequences. |

| Emotions | Low stress – mistakes are lessons. | High pressure – fear and greed can influence decisions. |

| Learning Value | Great for practicing order types, strategies, and basics of investing. | Great for experiencing the real psychology of trading. |

| Accessibility | Anyone can start, including students or beginners who want to learn stock market. | Requires funding an account, accepting risk, and more preparation. |

Paper trading is a training ground – it builds skills, confidence, and knowledge without risk. Real trading, on the other hand, introduces emotional and financial stakes that can’t be fully replicated in a stock market simulation. The smartest approach? Use paper trading to prepare, then gradually transition into live markets once you’re confident in your foundation.

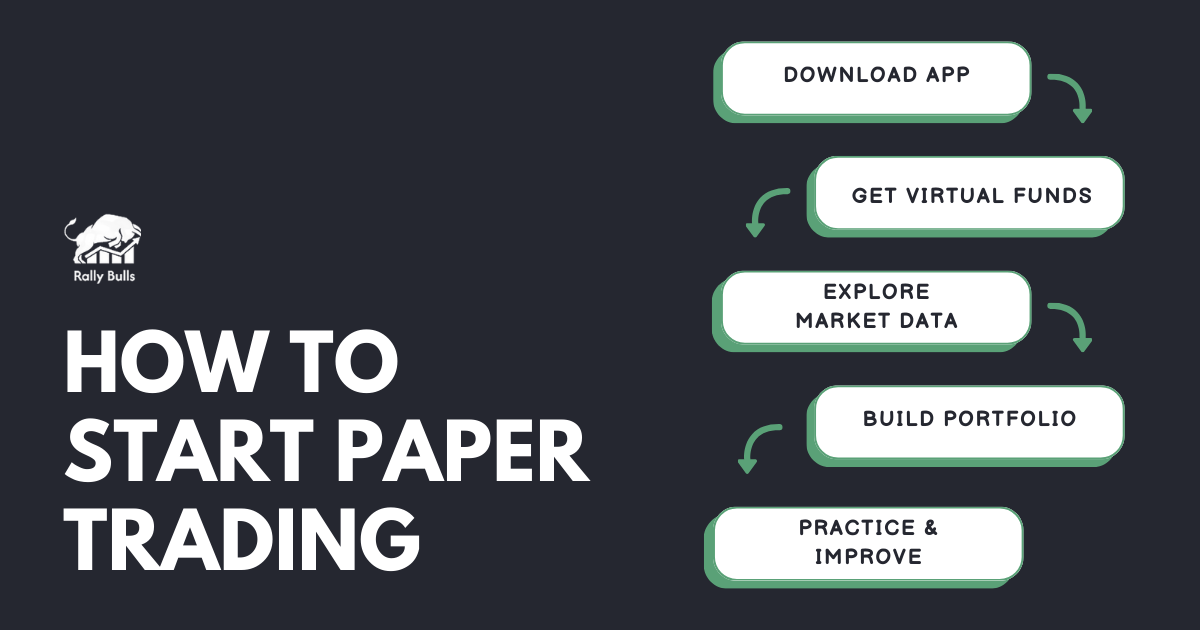

Getting started with paper trading doesn’t have to be complicated. With Rally Bulls, the process is designed to be simple, engaging, and educational – whether you’re brand-new to the stock market or brushing up on the basics of investing.

Rally Bulls is available on both the App Store and Google Play. Download it for free and create your account in minutes.

Every user starts with a pool of virtual money ($10,000). This gives you enough capital to test strategies, practice stock trading, and build diversified portfolios without any financial risk.

Unlike many simplified stock market simulation platforms, Rally Bulls is powered by real-time market feeds. This means your trades move with the same news, earnings reports, and price swings as real-world traders experience.

Choose from stocks, ETFs, or even crypto. You can try strategies like long-term investing, short-term trading, or sector-based allocations. Not sure where to begin? Use Rally Bulls’ AI-generated portfolios as inspiration.

The app doesn’t just let you trade – it teaches you along the way. With coaching, feedback, and gamified challenges, every trade becomes a learning opportunity. Over time, you’ll grow from simply experimenting to truly understanding how to learn stock market step by step.

By following these steps, you can start trading confidently in a risk-free environment. But what truly sets Rally Bulls apart is how it enhances paper trading with advanced tools, AI guidance, and gamified learning.

Not all paper trading platforms are created equal. Many apps offer simple simulations, but Rally Bulls takes things further – combining real-time data, AI coaching, and gamification to create the ultimate stock market simulation and learning experience.

Here’s how Rally Bulls makes paper trading smarter:

With Rally Bulls, you get a realistic paper trading simulator powered by live data. Every beginner can safely practice stock trading basics in a risk free stock trading environment – a perfect way to learn stock market trading before investing real money.

Meet Toro™, your personal AI trading coach. Toro explains concepts in plain language, answers questions, and helps you weigh risk versus reward. Want to know “What’s a stop-loss?” or “Should I diversify into ETFs?” Toro is there to guide you, making the basics of investing clear and actionable.

If you’re not sure where to start, Rally Bulls offers AI-generated portfolios built across strategies (growth, value, income), asset classes (stocks, ETFs, crypto), and risk levels. You can copy them, tweak them, or just watch how they perform – a perfect way to learn stock market with hands-on examples.

Rally Bulls isn’t just about placing trades. Its investment research module gives you access to technical indicators, fundamentals, and sentiment analysis – the same investment research tools used by professional traders. This helps you move beyond guesses and start making evidence-based decisions.

Learning doesn’t have to feel boring. With fantasy trading leagues, daily challenges, leaderboards, and Rally Coin rewards, Rally Bulls turns stock trading practice into an engaging, social experience. Competition motivates consistency, and consistency builds mastery.

Paper trading is one of the best ways to learn stock market, but to get the most out of it, you need to approach it with the right mindset. Here are some best practices to maximize your growth:

The biggest mistake beginners make is taking paper trading lightly. Even though you’re trading with virtual funds, imagine it’s your own capital. This mindset builds discipline and prepares you for live stock trading.

Don’t try to jump straight into complex strategies. Begin with the basics of investing: diversification, position sizing, and risk management. Once you master these fundamentals, you’ll have a stronger foundation for advanced strategies.

Use paper trading to test swing trading, day trading, or long-term investing. Because it’s a safe environment, you can compare how different strategies perform under the same stock market conditions.

Don’t just place trades – analyze them. Keep a journal or use Rally Bulls’ built-in dashboards to record why you entered a trade, how it performed, and what you learned. Reflection is how you turn mistakes into lessons.

Paper trading isn’t about “winning big” – it’s about learning. Set goals like “practice using stop-losses” or “maintain a diversified portfolio.” These goals keep you focused on growth rather than just hypothetical profits.

While paper trading is the safest way to learn stock market, many beginners fall into habits that limit their progress. Avoid these mistakes to make the most of your practice:

Because no real money is at risk, some traders treat paper trading like a game. This leads to unrealistic decisions. The fix? Treat your virtual portfolio as if it were real. This mindset builds discipline for actual stock trading.

New traders often go “all in” on a single stock, since there’s no financial downside. But in real markets, this can wipe out your account. Practice the basics of investing – diversification, stop-losses, and proper position sizing – even in a simulation.

It’s tempting to make dozens of trades a day just because you can. But frequent, careless trades don’t reflect real-world behavior. Instead, focus on quality trades that align with a strategy, whether in a live or stock market simulation.

Paper trading isn’t just about placing trades – it’s about learning from them. Many beginners skip reflection. Use tools like Rally Bulls’ dashboards or keep a journal to track what worked, what didn’t, and why.

Paper trading is a learning tool, not the destination. Some traders get too comfortable and never move into real markets. Avoiding these common mistakes ensures that your paper trading experience is meaningful. Once you’ve built consistent performance and discipline, you’ll be ready to transition into real trading safely and strategically.

Paper trading is a powerful tool, but at some point, every aspiring trader must move from simulation to the live stock market. Knowing when and how to make that transition is key to success.

Transitioning is not about rushing – it’s about preparation. Paper trading equips you with the knowledge, confidence, and basics of investing so that your entry into real stock trading is deliberate, informed, and much safer.

Paper trading is more than a practice tool – it’s the safest, smartest way to learn stock market and build confidence before risking real money. By using virtual funds to experiment with strategies, track performance, and develop discipline, beginners gain the skills they need to succeed in real stock trading.

With platforms like Rally Bulls, paper trading becomes a complete learning ecosystem:

By following best practices, avoiding common mistakes, and gradually transitioning to live trading, you can turn paper trading into a stepping stone toward confident, informed participation in the stock market.

Ready to start? Download Rally Bulls today and begin your journey to mastering trading – risk-free.

Rally Bulls is a financial education platform. All trading activity takes place in a simulated environment with virtual funds and does not involve real money or actual investment activity. Content provided is for educational and informational purposes only and should not be considered financial or investment advice.